TEMPLE, Texas — Property values have been going up as much as 40% in Central Texas and some homeowners are worried the trend will continue.

The good news: There are propositions on the May 7 special election ballot, which citizens can vote for right now, that can help reduce property taxes.

State of Texas Proposition 1 is not the easiest to understand, so feel free to skip to the translation below.

Proposition 1 states:

"The constitutional amendment authorizing the legislature to provide for the reduction of the amount of a limitation on the total amount of ad valorem taxes that may be imposed for general elementary and secondary public school purposes on the residence homestead of a person who is elderly or disabled to reflect any statutory reduction from the preceding tax year in the maximum compressed rate of the maintenance and operations taxes imposed for those purposes on the homestead."

Translation: Property owners who are over the age of 65, or disabled, could already qualify for having school district property taxes capped or frozen. After the State of Texas offered that option, the state compressed the tax rate related to school maintenance and operations (M&O). This proposition allows those same property owners to get their tax rate re-frozen at the new compressed rate.

Texas Senator Paul Bettencourt, who wrote the proposition, simplified it for 6 News another way.

"If you want your over 65 homeowner or disabled tax bills to go down, vote for Prop 1," Bettencourt said.

Bettencourt said the proposition was an effort to "thaw" and "re-freeze" school district tax rates so seniors could take advantage of permanent, lower tax rates if they are available.

Bettencourt said on his website this amendment would reduce the school tax bill for exemption holders an average of $110 next year. It said Proposition 1 would go into effect next year.

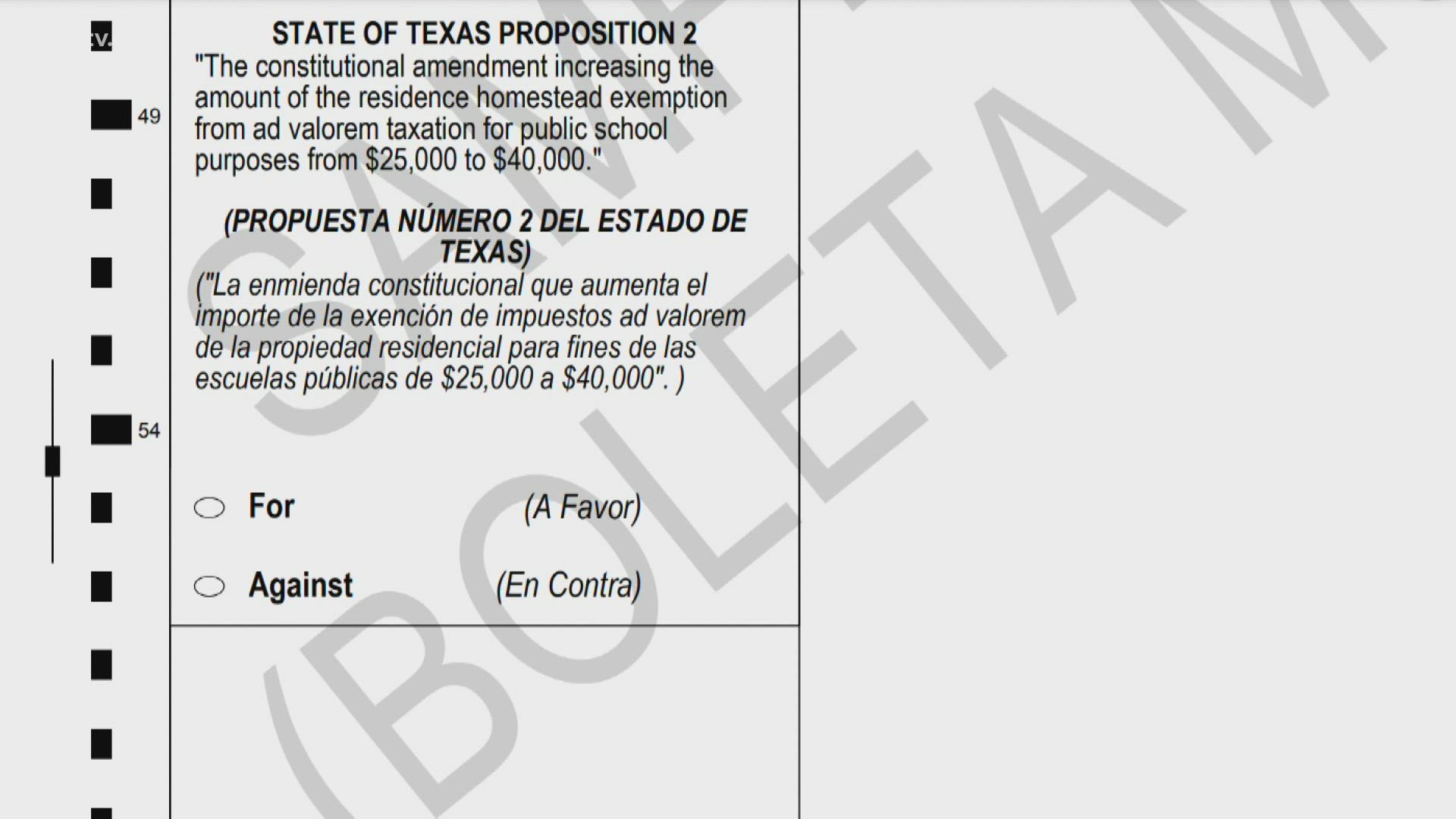

State of Texas Proposition 2 does not need a significant translation. It reads as follows:

"The constitutional amendment increasing the amount of the residence homestead exemption from ad valorem taxation for public school purposes from $25,000 to $40,000."

Homeowners who currently claim a homestead exemption currently have $25,000 deducted from the property value a school district can tax. If Proposition 2 passes, that amount goes to $40,000. Bettencourt's site said this amendment will go into effect this year if passed.

"That's about 5.6 million people. That's a big exemption out there," Bettencourt told 6 News.

Bettencourt said the state of Texas would pay school districts for any tax dollars lost as a result of these constitutional amendments. He told 6 News he hopes people will get out to the polls in support of both.

"Proposition 1 and 2 are both legitimate property tax relief. They are actual cuts for over65 homeowners and regular home owners," Bettencourt said. "People get to keep money in their pockets."

Also on KCENTV.com: