Unless you're lucky enough to win the lottery, financial savings start with the profit equation which consists of revenue and expenses. Meaning you will either have to increase your revenue or decrease your spending to balance out savings.

Statistics show that many are unprepared; and on average, members of the baby boomer generation only have $50,000 saved by the time they retire -- which is considered inadequate. So what can you do to help?

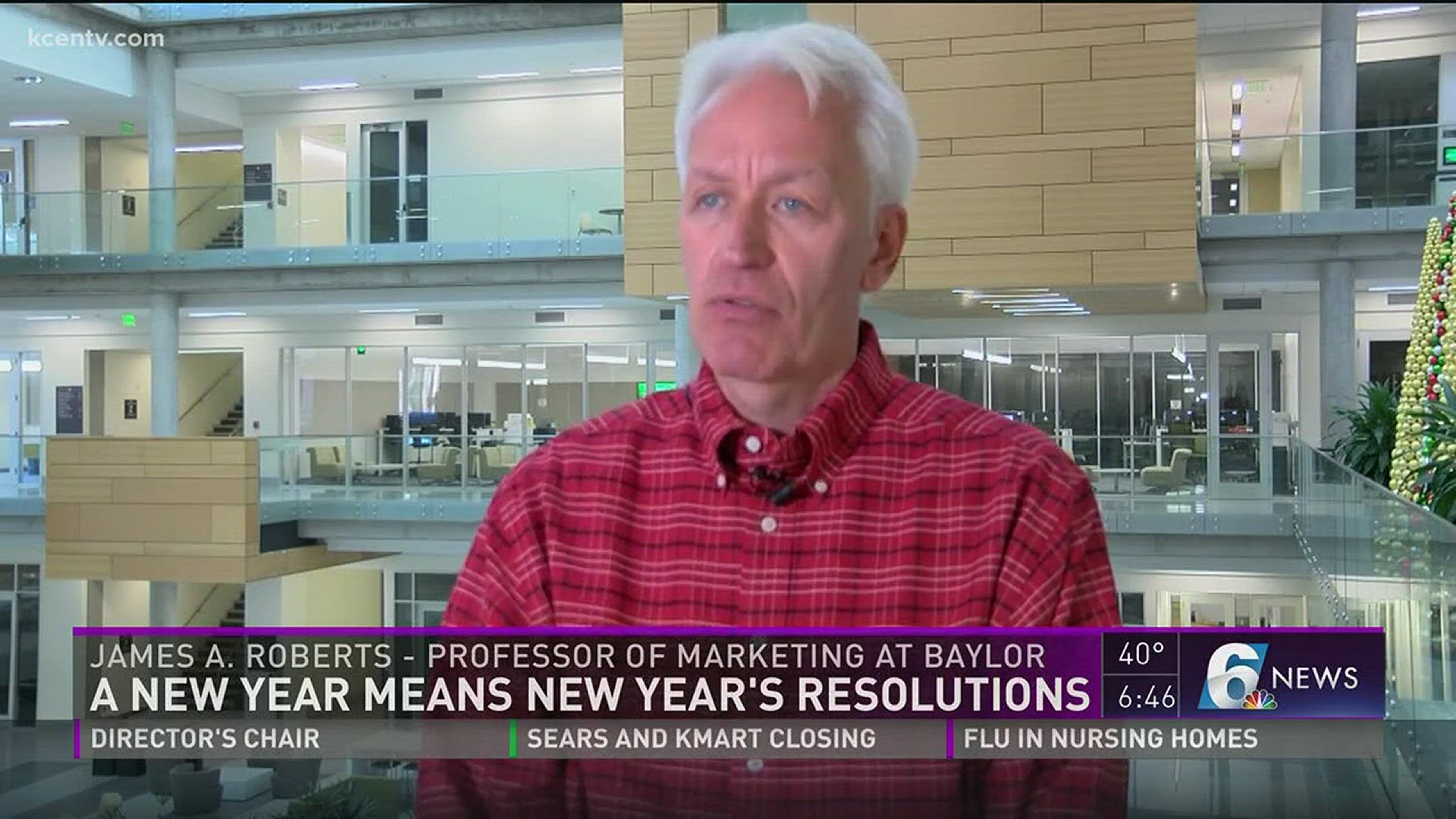

Professor of Marketing at Baylor University James A. Roberts said taking the process out of your hands is one of your best options.

In other words; the first thing you can do is make a saving an automatic deduction -- something that automatically comes out of your pay check before you ever see it. In a very short time, you'll forget that you're even making that deposit.

Professor Roberts also said that if you are finding in your current position you aren't able to save, picking up a casual second job can be a good idea and to use that pay check to start or beef up savings.

And when shopping...if something's over $100, walk out of the store. If you still want it the next day, you probably really wanted it or needed it, so it's okay to go back and get it.